*Updated 17th Dec 2021

If you are looking to purchase your second property then you must have heard of Additional Buyer Stamp Duty (ABSD) — a term that every property buyer dreads to hear. We hope to shed light on any questions that you might have as a buyer and how to avoid ABSD. Whether you are upgrading to a new home, or simply looking to expand your portfolio. Ready? Let’s dive right in!

What exactly is Additional Buyer’s Stamp Duty (ABSD)?

ABSD is a tax that’s levied on top of the compulsory Buyer’s Stamp Duty. You are liable for ABSD if you fall into one of the four categories below:

- A Singapore Citizen (SC) who is purchasing your 2nd and subsequent residential property.

- A Permanent Resident (PR) who is purchasing your 1st and subsequent residential property.

- A foreigner* who is purchasing any residential property.

- An entity (company or association) that is purchasing any residential property.

*Nationals and Permanent Residents of Iceland, Liechtenstein, Norway and Switzerland, and Nationals of the United States of America are accorded the same Stamp Duty treatment as Singapore Citizens, under Free Trade Agreements (FTAs).

Why do I have to pay ABSD?

ABSD first took effect on 8th December 2011, alongside a slew of other cooling measures that the government implemented amid early signs of an overheating property market.

If prices were allowed to rise rampantly, many Singaporeans could well be priced out of reach for an affordable home. Worse still, it can lead to a housing bubble, which has even more far-reaching repercussions on the economy and people.

ABSD, like other existing cooling measures, such as Seller Stamp Duty (SSD) and Loan-to-value (LTV) ratio requirements, were put in place to curb speculation. These cooling measures stabilize the residential property market and keep housing prices affordable for Singaporeans.

It would seem that ABSD is here to stay for the long term. At the time this article was written, the government maintains that there are no plans to remove property cooling measures

So, how much ABSD do I actually have to pay?

The ABSD rate payable primarily depends on your residency status and nationality at the time of your property purchase. While there have been a few rounds of revisions to the rates since its inception, here is the latest iteration of those rates, as announced on 6th July 2018:

| IF YOU ARE A… | ABSD |

| SC buying your 1st property | No ABSD |

| SC buying your 2nd property | 12% |

| SC buying your 3rd or subsequent property | 15% |

| PR buying your 1st property | 5% |

| PR buying your 2nd or subsequent property | 15% |

| Foreigner buying any property* | 20% |

| Entity buying any property | 25% |

Like BSD, your ABSD is computed based on the higher of the purchase price or valuation of the property.

Example: Jeff got a great deal for an apartment at $1 million, as the valuation for the property was $1.1 million. Assuming that this will be his second property, he is subjected to an ABSD rate of 12%. And so, the ABSD amount that he’ll have to pay will be $1.1 million x 12% = $132,000.

*Update, Higher ABSD Rates With New Cooling Measures Effective on 16th Dec 2021.

On the 15th of December 2021 at 11.40pm, the government announced a new set of cooling measures to help slow down the growth of an extremely buoyant property market. The new cooling measures take effect on the 16th of Dec 2021 and affect all OTPs issued on or before the 16th. If your OTP was issued before the 16th of Dec and will be exercised before the 5th of Jan 2022, you will be spared from the price hike.

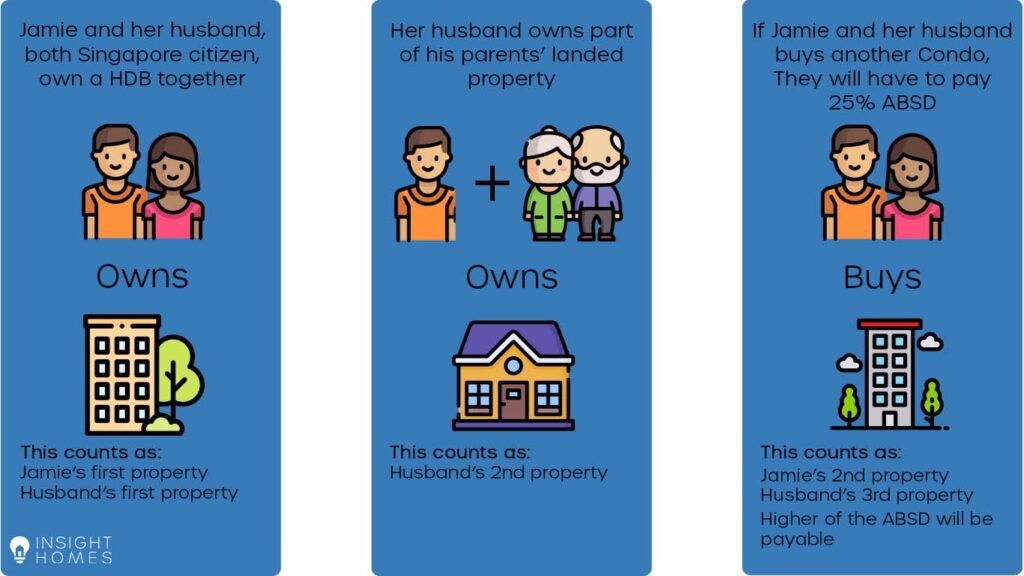

How is ABSD calculated if I’m buying a property with somebody else?

When you’re buying a property with someone else, different ABSD rates may apply to both of you. If the property is owned by more than two persons under Tenancy-in-common, ABSD will apply to each individual. The ABSD that is payable will be based on the higher rate.

For example:

Jamie and her husband are both Singaporean citizens, and they own a HDB flat together. Jamie does not own any other property, but her husband has partial ownership of his parent’s landed property. They have been shopping for a second property as an investment, and it’ll be Jamie’s second property, so her ABSD rate is 12% 17%. However, it’ll be her husband’s third property, and his ABSD rate will be 15% 25%. The ABSD rate that is payable for their new property will then be 15% 25%.

Are there any exemptions from ABSD?

Here are some situations you can be exempted from ABSD:

Sell your existing property before purchasing a new one

You avoid paying ABSD as long as you have signed on the agreement to sell your current property before exercising the Option to Purchase (OTP) for your next property.

Downgrading from private property to resale HDB flat

You do not have to pay ABSD if you’re selling your private property to move into a resale HDB flat. You must, however, sell off the private property within six months from the completion date of the flat. This must also be the the only property you own at that time.

Upgrading from HDB flat to new Executive Condominium (EC)

You are not required to pay ABSD upfront when buying an EC, unlike private properties that rely on a refund. You are, however, still required to sell off your HDB flat within six months of the EC obtaining its Temporary Occupation Permit (TOP) or Certificate of Statutory Completion (CSC), whichever is earlier.

Remission for married couples

If you have just gotten married (congratulations!) and are looking to buy a matrimonial home with your spouse, but one or both of you already own a property (wholly or partially), you could still be eligible for an ABSD refund.

To qualify, you will have to sell the old property within six months after you have bought the new one. The second property must be purchased under both names of the couple only with at least one of you a Singapore Citizen.

You can find the full eligibility criteria on IRAS website here.

Eligible foreigners

Earlier on, we wrote that the nationals and / or residents from certain countries in Free Trade Agreements with Singapore, enjoy the same ABSD rates as would a Singapore Citizen. All other foreigners are required to pay a staggering 20%. *Update, as of 16 Dec 2021, Foreigners will have to pay 30% ABSD.

However, there is one exception to that rule — a foreigner or Permanent Resident who is married to a Singaporean, and does not own any residential property, can avoid paying ABSD on their first home.

How to avoid ABSD?

Even if you do not fit into any of the scenarios that we’ve just described, it is still possible for you to buy a second property and avoid ABSD. We have outlined the various ways below, and highlighted the important things that you need to know:

De-coupling an owner from the current property

De-coupling simply means taking a person’s ownership out of a property, by transferring his or her shares to the co-owner(s). This allows the person to buy a new property as his or her first home, effectively reducing ABSD, or even avoiding it altogether.

This transfer of ownership works exactly the same way as a normal sale and purchase would, which means that you can buy a new private property without ABSD as soon as the sale is exercised! However, HDB owners cannot de-couple without specific reasons, such as divorce, death or loss of citizenship.

Of course, this method comes with its costs. Buyer Stamp Duty (BSD) is payable on the value of the shares that is being transferred, and there are the legal fees of the conveyancing lawyers representing each party.

Also, if de-coupling happens within three years from when the property was first purchased, you could be liable for Seller Stamp Duty (SSD) at the rate of 4-12% depending on the year of transfer.

Finally, a couple more things to consider before you embark on this route:

All CPF monies used by the transferor (exiting party) in paying for the property will have to be refunded to his or her CPF account, plus accrued interest, upon completion of the sale. The implication here is that you must have sufficient cash and CPF to pay for this refund.

Also, if the purchase of the property was financed by a mortgage loan, then the transferee will have to check with their bank on the restructuring or refinancing of the loan. The new owner must have sufficient income to take over the full loan.

Purchase under a child’s name (above 21 years old)

You could consider buying a private property under your child’s name (must be above 21 years old) by providing the cash for downpayment, assuming that he or she is a first-time property owner and is unaffected by ABSD.

Your child must also be eligible for the mortgage loan of the property that you’re buying. This means that they will need to have sufficient income as proof, since you aren’t legally the owner, and your income cannot be used for the loan application.

Even after satisfying all of the above requirements, you have to be aware that the issues accompanying this method may not arise until much later.

Now that your child is the owner of a private property, if he or she gets married and wants to buy a private property for their matrimonial home, they will then be hit with ABSD for the new property.

The alternative will be for you to either sell (which presents its own set of problems depending on the lease status of the property or the resale market conditions at that time), or transfer the property back to yourself. That could mean incurring even more ABSD, if the property in question has increased in value.

Also, your child will no longer be eligible to buy a Build-to-order (BTO) flat or new Executive Condominium (EC) from the government, unless the private property is disposed of at least 30 months before their application. That’s a long time for newly-weds.

Purchase under trust (below 21 years old)

You could also consider setting up a property trust for your child of below 21 years old, and then buying a property under your child’s name.

This method will require you to pay for the property, along with all of the other related costs, such as BSD and legal fees in full using cash. You will not be allowed to use your CPF and banks do not extend loans for properties bought under a trust.

Do keep in mind that, as with the last method, the property belongs to your child, as the beneficiary of the trust. The upside will be that you don’t have to pay ABSD since you are not the legal owner of the property.

How do I pay for ABSD?

There are several ways to pay for ABSD.

The easiest would be to pay via IRAS e-Stamping Portal using NETS, cheque or cashier’s order.

Alternatively, you can make payment at the e-kiosks located at the Taxpayer & Business Service Centre (Level 1 main lobby of Revenue House), or at SingPost service bureaus. Do note that there are only 4 of such branches — Novena (also at Revenue House), Raffles Place (Ocean Financial Centre, Shenton Way (Downtown Gallery) and Chinatown (People’s Park Centre). You can find their opening hours on SingPost’s website.

There are no fees for doing it yourself on the e-Stamping portal, and at the e-kiosks. However, SingPost charges $10 – $35 for the service, and you’re advised to download and complete a requisition form before heading down.

You should also know that you can utilise the savings in your CPF (OA) account to pay any stamp duty when purchasing a property, ABSD included! However, you’ll still have to first pay in cash, and then apply for reimbursement from CPF.

Lastly, the deadline for payment is within 14 days of purchasing the property and signing of the purchase agreement. If the document was signed overseas, payment has to be made within 30 days after receiving the document in Singapore.

It is recommended that you pay ABSD (or any stamp duty, for the matter) in a timely manner. The penalty for late payment can be as much as 4x the amount of unpaid duty.

What is on the horizon? (Final Thoughts)

2020 has been a tumultuous year, to say the least. There were speculations that the temporary COVID-19 relief measures (essentially schedule extensions for developers and couples looking to claw back on ABSD) rolled out by the government signals further easing of the cooling measures down the road.

However, in a TODAY report as recent as July 2020, the managing director of Monetary Authority of Singapore (MAS), Mr Ravi Menon said that there is no need for easing of the current property curbs, as “the adjustment of the property market has been modest” and that the government will continue to watch the market in ensuring that prices for private residential properties remain stable. Talk about hearing it straight from the horse’s mouth.

Hence, it is probably secure to say that ABSD isn’t going away anytime soon. What’s important is that, at the end of the day, you should assess your financial situation and family needs, and then plan for the purchasing strategy that is most suitable for you.

If you still have questions, simply contact us for advice on ABSD that’s tailored to you.